This CPD training is completely online. You can view this training, stop any time, and continue any time. At the end of this training there is a quiz (multiple choice). Once completed you will be able to download your certificate. You can take the quiz as many times as you need until you succeed. The certificates are digital and verifiable on our website.

CPD

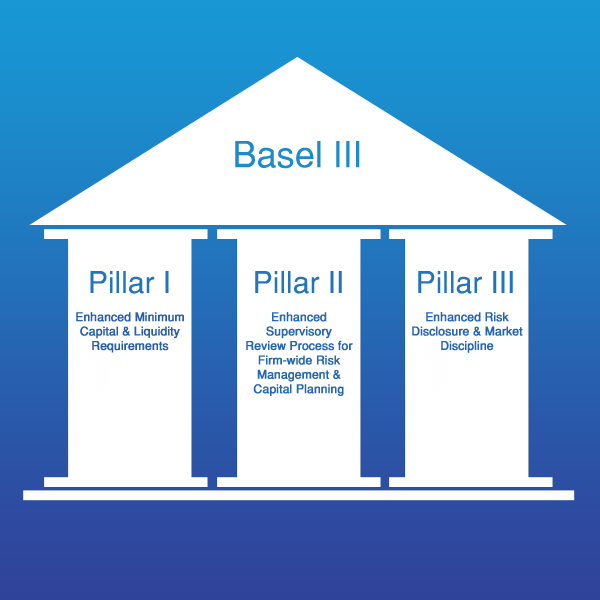

[1 hour] Basel III [2024]

20,00 €

This course should be completed before 31.12.2024 in order to have a valid certificate for 2024

Reviews

There are no reviews yet.